Morgan Stanley Fixed-Global Macro Strategy Positions and Flows Report-108958834.pdf

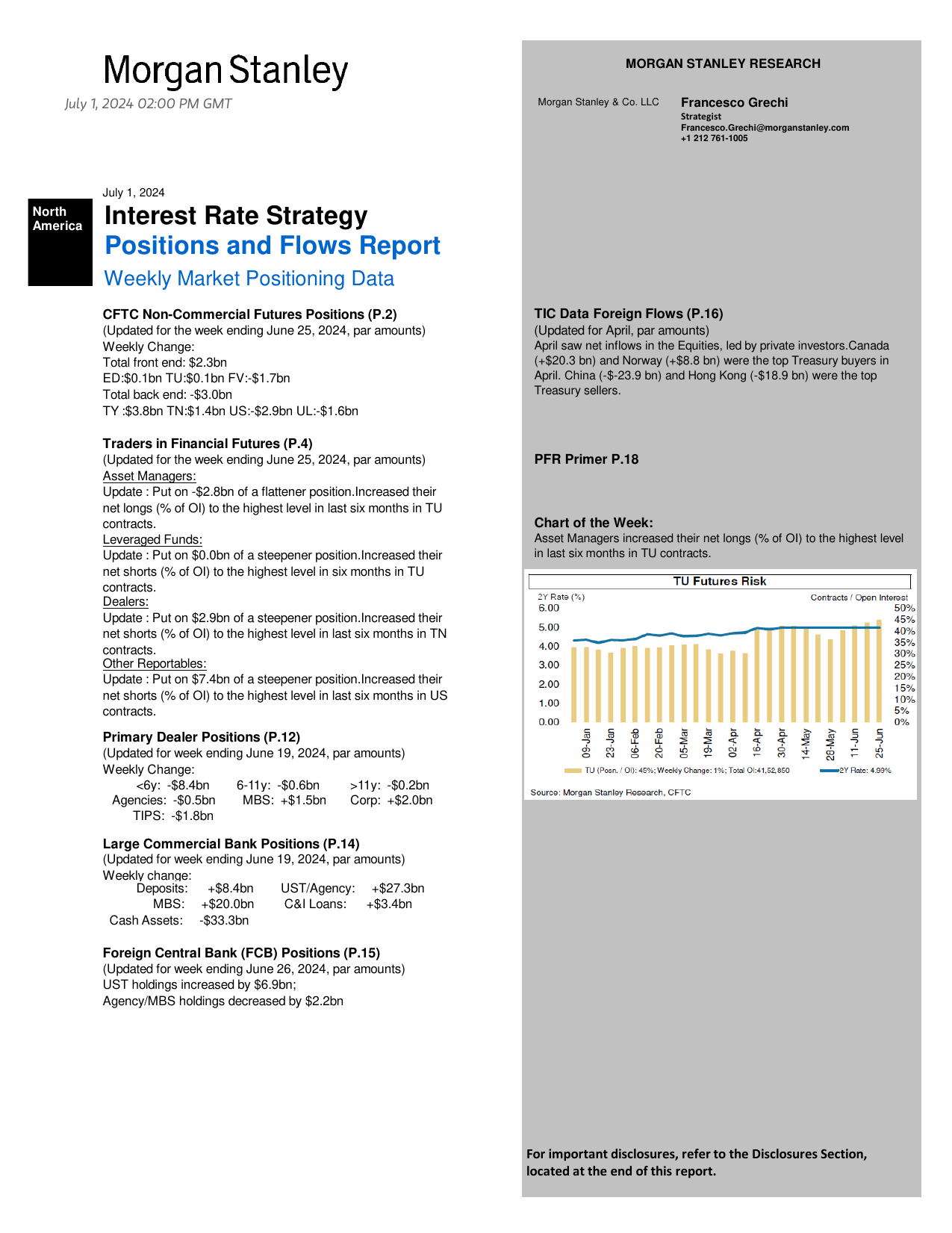

MORGANSTANLEYRESEARCHJuly1,2024InterestRateStrategyPositionsandFlowsReportWeeklyMarketPositioningDataCFTCNon-CommercialFuturesPositions(P.2)TICDataForeignFlows(P.16)(UpdatedfortheweekendingJune25,2024,paramounts)(UpdatedforApril,paramounts)WeeklyChange:Totalfrontend:$2.3bnED:$0.1bnTU:$0.1bnFV:-$1.7bnTotalbackend:-$3.0bnTY:$3.8bnTN:$1.4bnUS:-$2.9bnUL:-$1.6bnTradersinFinancialFutures(P.4)(UpdatedfortheweekendingJune25,2024,paramounts)PFRPrimerP.18AssetManagers:Update:Puton-$2.8bnofaflattenerposition.Increasedtheirnetlongs(%ofOI)tothehighestlevelinlastsixmonthsinTUcontracts.ChartoftheWeek:LeveragedFunds:Update:Puton$0.0bnofasteepenerposition.Increasedtheirnetshorts(%ofOI)tothehighestlevelinsixmonthsinTUcontracts.Dealers:Update:Puton$2.9bnofasteepenerposition.Increasedtheirnetshorts(%ofOI)tothehighestlevelinlastsixmonthsinTNcontracts.OtherReportables:Update:Puton$7.4bnofasteepenerposition.Increasedtheirnetshorts(%ofOI)tothehighestlevelinlastsixmonthsinUScontracts.PrimaryDealerPositions(P.12)(UpdatedforweekendingJune19,2024,paramounts)WeeklyChange:11y:-$0.2bnSource:MorganStanleyResearch,CFTCAgencies:-$0.5bnMBS:+$1.5bnCorp:+$2.0bnTIPS:-$1.8bnLargeCommercialBankPositions(P.14)(UpdatedforweekendingJune19,2024,paramounts)Weeklychange:Deposits:+$8.4bnUST/Agency:+$27.3bnMBS:+$20.0bnC&ILoans:+$3.4bnCashAssets:-$33.3bnForeignCentralBank(FCB)Positions(P.15)(UpdatedforweekendingJune26,2024,paramounts)USTholdingsincreasedby$6.9bn;Agency/MBSholdingsdecreasedby$2.2bnAssetManagersincreasedtheirnetlongs(%ofOI)tothehighestlevelinlastsixmonthsinTUcontracts.AprilsawnetinflowsintheEquities,ledbyprivateinvestors.Canada(+$20.3bn)andNorway(+$8.8bn)werethetopTreasurybuyersinApril.China(-$-23.9bn)andHongKong(-$18.9bn)werethetopTreasurysellers.NorthAmericaaAmericaNorthMorganStanley&Co.LLCFrancescoGrechiStrategistFrancesco.Grechi@morganstanley.com+1212761-1005Forimportantdisclosures,refertotheDisclosuresSection,locatedattheendofthisreport.July1,202402:00PMGMTUSInterestRatesStrategy-ResearchJuly01,2024PositionsandFlowsReportUpdatedfortheweekendingJune25,2024Steepener/FlattenerFuturesRiskvs.2s10s(LT)Steepener/FlattenerFuturesRiskvs.2s10s(ST)Source:MorganStanleyResearch,CFTCSource:MorganStanleyResearch,CFTCFront-EndFuturesRiskvs.UST2y-3MBills(LT)Front-EndFuturesRiskvs.UST2y(ST)Source:MorganStanleyResearch,CFTCSource:MorganStanleyResearch,CFTCBack-EndFuturesRiskvs.UST10y-3MBills(LT)Back-EndFuturesRiskvs.UST10y(ST)Source:MorganStanleyResearch,CFTCSource:MorganStanleyResearch,CFTCUpdate:Non-commercialsadded$2.3bn10yequiv.inthefrontend,andremoved$3.0bn10yequiv.inthebackend,puttingon$5.3bnofasteepenerposition.CFTCNon-CommercialFuturesPositions-150-100-50050100150200250300350-150-100-500501002005201020152020SteepenerFuturesPositioningRisk(10yequivalents$bn)Front-end-Back-endRisk:-$115.4bn;weeklychange:$5.3bnLast2s10s(RHS)2s10s(bp)-120-100-80-60-40-20020-160-140-120-100-80-60-40-2002040Jun22Sep22Dec22Mar23Jun23Sep23Dec23Mar24Jun24SteepenerFuturesPositioningRisk(10yequivalents$bn)Front-e