Morgan Stanley-SA Strategy Monthly Round-Up Inflation moderation-.pdf

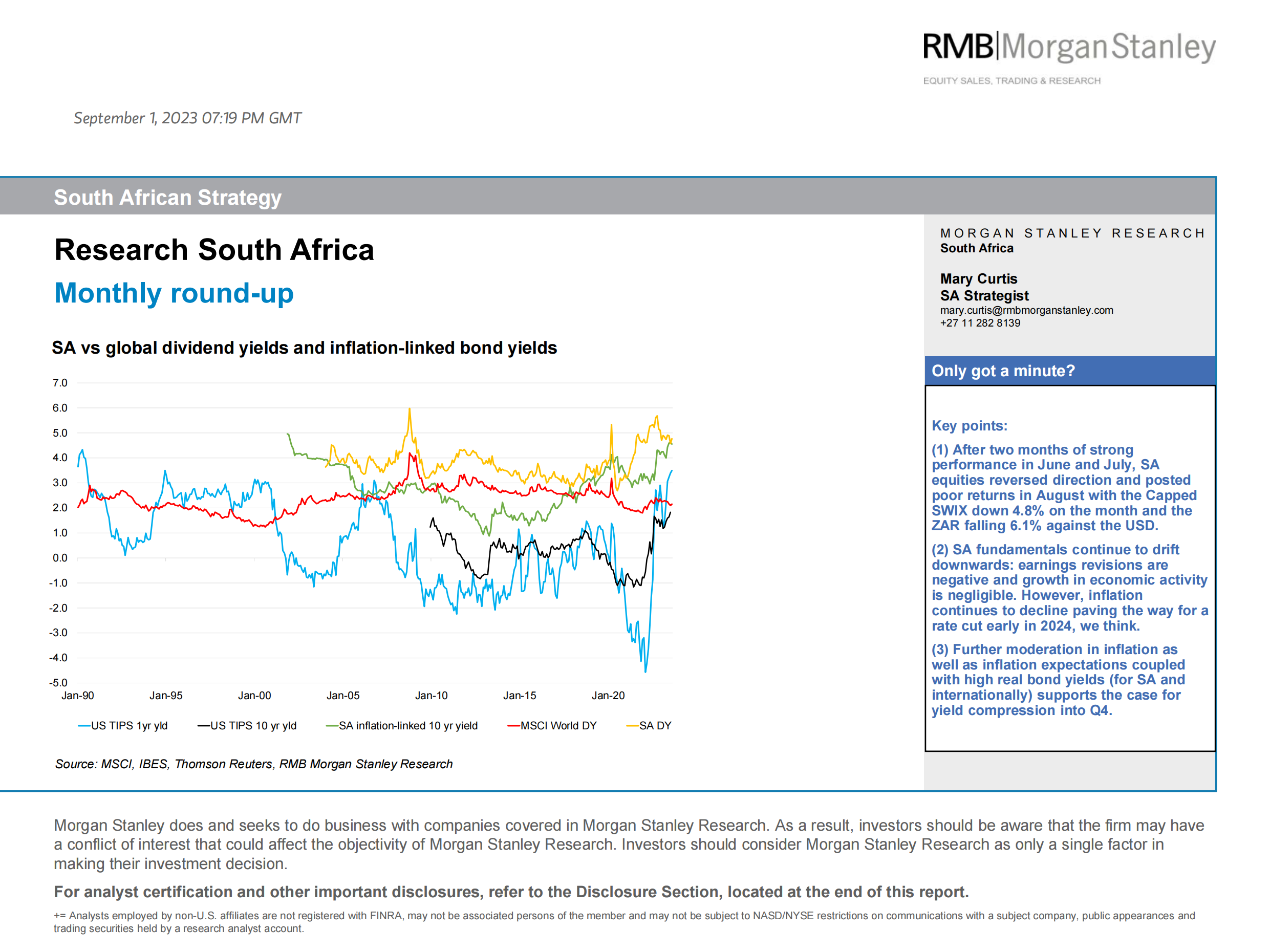

ResearchSouthAfricaMonthlyround-upMORGANSTANLEYRESEARCHSouthAfricaMaryCurtisSAStrategistmary.curtis@rmbmorganstanley.com+27112828139SouthAfricanStrategyMorganStanleydoesandseekstodobusinesswithcompaniescoveredinMorganStanleyResearch.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofMorganStanleyResearch.InvestorsshouldconsiderMorganStanleyResearchasonlyasinglefactorinmakingtheirinvestmentdecision.Foranalystcertificationandotherimportantdisclosures,refertotheDisclosureSection,locatedattheendofthisreport.+=Analystsemployedbynon-U.S.affiliatesarenotregisteredwithFINRA,maynotbeassociatedpersonsofthememberandmaynotbesubjecttoNASD/NYSErestrictionsoncommunicationswithasubjectcompany,publicappearancesandtradingsecuritiesheldbyaresearchanalystaccount.Onlygotaminute?Keypoints:(1)AftertwomonthsofstrongperformanceinJuneandJuly,SAequitiesreverseddirectionandpostedpoorreturnsinAugustwiththeCappedSWIXdown4.8%onthemonthandtheZARfalling6.1%againsttheUSD.(2)SAfundamentalscontinuetodriftdownwards:earningsrevisionsarenegativeandgrowthineconomicactivityisnegligible.However,inflationcontinuestodeclinepavingthewayforaratecutearlyin2024,wethink.(3)Furthermoderationininflationaswellasinflationexpectationscoupledwithhighrealbondyields(forSAandinternationally)supportsthecaseforyieldcompressionintoQ4.Source:MSCI,IBES,ThomsonReuters,RMBMorganStanleyResearch-5.0-4.0-3.0-2.0-1.00.01.02.03.04.05.06.07.0Jan-90Jan-95Jan-00Jan-05Jan-10Jan-15Jan-20USTIPS1yryldUSTIPS10yryldSAinflation-linked10yryieldMSCIWorldDYSADYSAvsglobaldividendyieldsandinflation-linkedbondyieldsSeptember1,202307:19PMGMTRMBMORGANSTANLEYRESEARCHSeptember1,20232SouthAfrica:AugustSummaryandSeptemberOutlook•AftertwomonthsofstrongperformanceinJuneandJuly,SAequitiesreverseddirectionandpostedpoorreturnsinAugust:theCappedSWIXindexendeddown4.8%forthemonth(inZARterms)andtheZARpulledback6.1%againsttheUSD.WithinSAequities,financialsoutperformedagain(downonly1.6%onthemonth)comparedtoIndustrials(down4.7%)andResources(down8.4%).SAbondsfaredrelativelywellwiththe10yeartotalreturnonlydown0.1%despitetheweaknessintheZAR.YTDbondsarenowup5.6%vstheCappedSWIXat2.7%YTD.•Whatstandsoutinthedatapackthismonth:1)Despitethestarkdivergenceinsub-sectorperformance,volatilityoftheALSIisclosetopost-covidlowsat18.8(onaverageoverthelastweek)vsthe3yearaverageof21.8.•2)Technicals(slides12-13)lookneutralfortheALSI,JSEFinancialsandJSEIndustrialsbuttheJSEResourceindexisdownatthe200daymovingaveragesupportlevel.•3)ConsensusearningsrevisionsratchetedloweragaininAugust,down2.3%bringingthe3monthrevisionto-8.9%drivenlowerbyminers,telcosandNaspers.•4)Weincludeaguestchartonslide3toshowavaluationsummaryofSAvsglobaldividendyieldsandinflation-linkedbondyields.SAyieldsarehighcomparedtoglobalcounterpartsbutthekeypointisthatrealbondyieldslookhighcomparedtoequitydividendyields(forbothSAandinternationally),particularlygivenanoutlookoffallinginflationandgrowthconcerns.•5)Onthemacrofront,threekeypointsare:(i)inflationconti