UBS Economics-APAC Economic Perspectives _Asia by the Numbers (March 2024)...-107260930.pdf

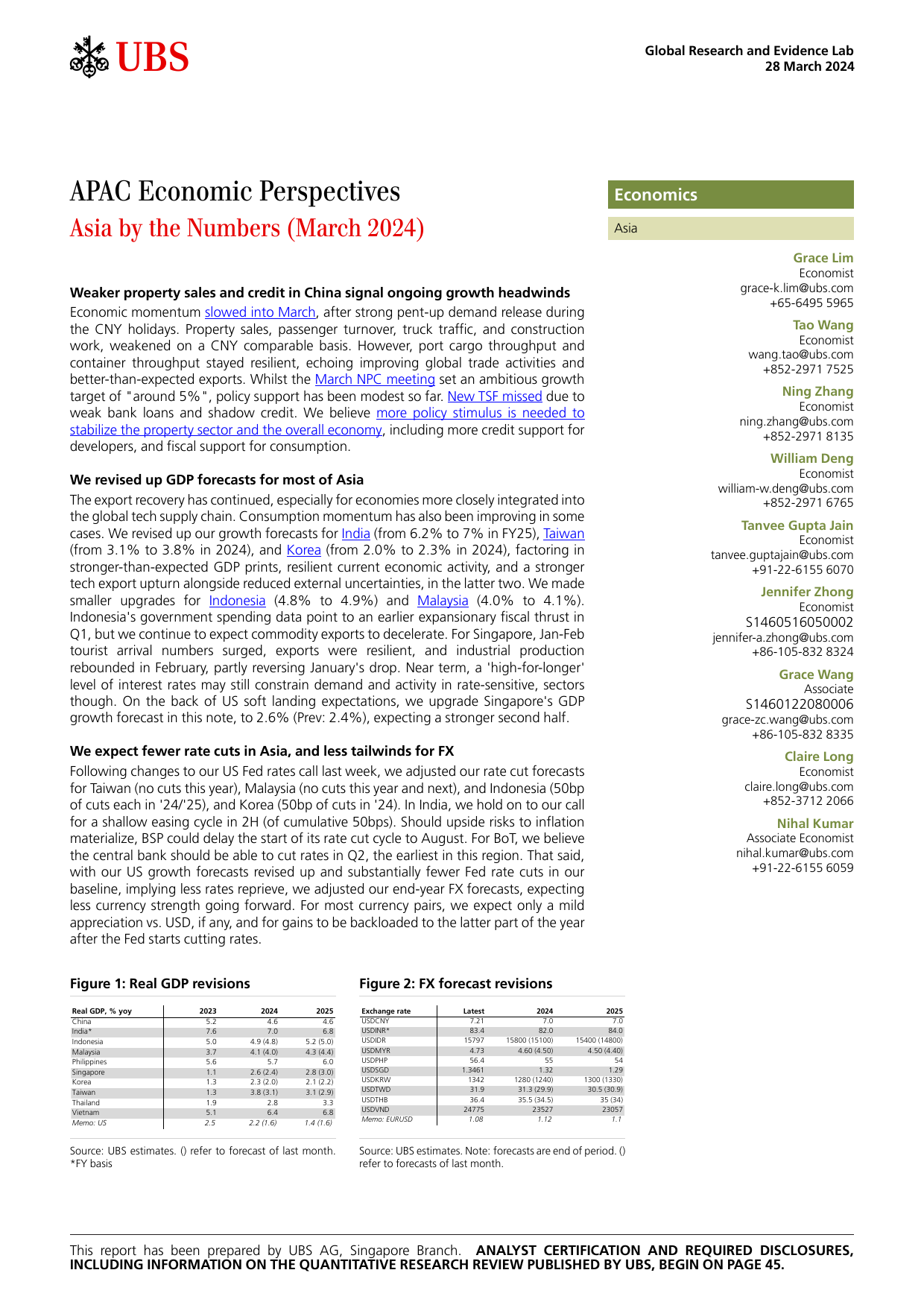

ab28March2024GlobalResearchandEvidenceLabAPACEconomicPerspectivesAsiabytheNumbers(March2024)WeakerpropertysalesandcreditinChinasignalongoinggrowthheadwindsEconomicmomentumslowedintoMarch,afterstrongpent-updemandreleaseduringtheCNYholidays.Propertysales,passengerturnover,trucktraffic,andconstructionwork,weakenedonaCNYcomparablebasis.However,portcargothroughputandcontainerthroughputstayedresilient,echoingimprovingglobaltradeactivitiesandbetter-than-expectedexports.WhilsttheMarchNPCmeetingsetanambitiousgrowthtargetof"around5%",policysupporthasbeenmodestsofar.NewTSFmissedduetoweakbankloansandshadowcredit.Webelievemorepolicystimulusisneededtostabilizethepropertysectorandtheoveralleconomy,includingmorecreditsupportfordevelopers,andfiscalsupportforconsumption.WerevisedupGDPforecastsformostofAsiaTheexportrecoveryhascontinued,especiallyforeconomiesmorecloselyintegratedintotheglobaltechsupplychain.Consumptionmomentumhasalsobeenimprovinginsomecases.WerevisedupourgrowthforecastsforIndia(from6.2%to7%inFY25),Taiwan(from3.1%to3.8%in2024),andKorea(from2.0%to2.3%in2024),factoringinstronger-than-expectedGDPprints,resilientcurrenteconomicactivity,andastrongertechexportupturnalongsidereducedexternaluncertainties,inthelattertwo.WemadesmallerupgradesforIndonesia(4.8%to4.9%)andMalaysia(4.0%to4.1%).Indonesia'sgovernmentspendingdatapointtoanearlierexpansionaryfiscalthrustinQ1,butwecontinuetoexpectcommodityexportstodecelerate.ForSingapore,Jan-Febtouristarrivalnumberssurged,exportswereresilient,andindustrialproductionreboundedinFebruary,partlyreversingJanuary'sdrop.Nearterm,a'high-for-longer'levelofinterestratesmaystillconstraindemandandactivityinrate-sensitive,sectorsthough.OnthebackofUSsoftlandingexpectations,weupgradeSingapore'sGDPgrowthforecastinthisnote,to2.6%(Prev:2.4%),expectingastrongersecondhalf.WeexpectfewerratecutsinAsia,andlesstailwindsforFXFollowingchangestoourUSFedratescalllastweek,weadjustedourratecutforecastsforTaiwan(nocutsthisyear),Malaysia(nocutsthisyearandnext),andIndonesia(50bpofcutseachin'24/'25),andKorea(50bpofcutsin'24).InIndia,weholdontoourcallforashalloweasingcyclein2H(ofcumulative50bps).Shouldupsideriskstoinflationmaterialize,BSPcoulddelaythestartofitsratecutcycletoAugust.ForBoT,webelievethecentralbankshouldbeabletocutratesinQ2,theearliestinthisregion.Thatsaid,withourUSgrowthforecastsrevisedupandsubstantiallyfewerFedratecutsinourbaseline,implyinglessratesreprieve,weadjustedourend-yearFXforecasts,expectinglesscurrencystrengthgoingforward.Formostcurrencypairs,weexpectonlyamildappreciationvs.USD,ifany,andforgainstobebackloadedtothelatterpartoftheyearaftertheFedstartscuttingrates.Figure1:RealGDPrevisionsRealGDP,%yoy202320242025China5.24.64.6India*7.67.06.8Indonesia5.04.9(4.8)5.2(5.0)Malaysia3.74.1(4.0)4.3(4.4)Philippines5.65.76.0Singapore1.12.6(2.4)2.8(3.0)Korea1.32.3(2.0)2.1(2.2)Taiwan1.33.8(3.1)3.1(2.9)Thailand1.92.83.3Vietnam5.16.46.8Memo:US2.52.2(1.6)1.4(1.6)Source:UBSestimates.()refertoforecastoflastmonth.*FYbasisFigure2:FXforecastrevisionsExcha